The 11th Annual Family Office Super Summit

The #1 private investor club event with 400 investors and more ultra-wealthy investors on stage than any other event globally

December 10th-12th, 2024

Key Biscayne, Florida

Join us for our 11th annual Super Summit with 125+ speakers on stage, 10 networking sessions, 1,000+ attendees, and more ultra-wealthy family offices and private investors on stage than any other event in the industry.

The 3-day Super Summit will be one of the best opportunities of the year if you are looking for investors and JV partners for real estate deals, tech deals, healthcare deals, wealth management funds, and other alternative investments.

We have spent $25M running our investor club and hosting 275+ live events the last 17 years, and are the #1 global thought leader on family offices with over 10 published books and 11 million social media followers and group members. We ensure every event is dynamic, fast-paced, and ask every investor on stage what they are allocating into right now.

Speakers That Joined Us in 2023

Mark Victor Hansen

Co-Author of the Chicken Soup for the Soul Book Series

Joe Williams

Co-Founder, Keller Williams

Marques Ogden

Former NFL Player & Keynote Speaker

Pierre duPont

$20B+ in AUM MFO

Dr. Jacque Sokolov

SFO – (2) $1B+ Exits

Simoni M.

Ra’anan B.

Sponsor

Dr. Forrest B.

Multi-Family Office

Benjamin M.

Fund of Funds

Hubert Z.

Angel Investor

Jack H.

Sponsor

Maurice J.

Sponsor

Chris P.

Single Family Office

Gregory P.

Single Family Office

Alice C.

RE Investor

Anil D.

Private Investor

Marc H.

Private Investor

Carl F.

RE investor

Sylvia B.

Single Family Office

Paul K.

Multi-Family Office

Alexandra C.

Single Family Office

Bo P.

RE Investor

Rick C.

Sponsor

Sachin P.

Wealth Manager

Ole M.

Single Family Office

Brian W.

Wealth Manager

Nick B.

OCIO

James B.

Private Investor

Irwin B.

Single Family Office

Bridgette S.

Angel Investor

Kamil H.

Ultra-Weathly Investor (SFO)

Cliff O.

Multi-Family Office

LaVonne I.

Litan Y.

Private Investor

Marc S.

RE Investor

Danny M.

Private Investor

John H.

RE Investor

Will W.

Single Family Office

John B.

Wealth Manager

Shane S.

Doctor/Dentist

Harry K.

Private Investor

Giorgi A.

Single Family Office

Nick N.

RE Investor

Tommy M.

Multi-Family Office

Adam F.

Private Investor

Joel N.

Single Family Office

Alec W.

Private Investor

DJ Van K.

RE Investor

Steven S.

Multi-Family Offices

Alex K.

SFO

Adam Q.

Wealth Manager

Jared S.

Angel Investor

James K.

Private Investor

Alec R.

Single Family Office

David D.

Wealth Manager

Ken H.

Single Family Office

Ira P.

Single Family Office

Brenton S.

Real Estate Investor

Brittany A.

Wealth Manager

Eric T.

Doctor

Ken G.

Private Investor

Simon L.

Angel Investor

Trase B.

Private Investor

John L.

Single Family Office

Matt L.

Sponsor

Neetu P.

Single Family Office

Jay Kelley

Return on Good

Ann Oleson

Return on Good

Richard C. Wilson

CEO, Family Office Club

Andres Ospina

PitchDecks.com

Dr. Dolf R.

Private Investor

Michael S.

Sponsor

Jason M.

Sponsor

Patrick T.

Sponsor

Justus P.

Private Investor

Garrett K.

SFP

Shane N.

Private Investor

Robert H.

Sponsor

Stephanie L.

Angel Investor

Manoel S.

Sponsor

Henry E.

Private Investor

Suzanne M.

SFO

Todd S.

Sponsor

Josh M.

Real Estate Investor

Alex D.

Sponsor

Matt K.

Wealth Manager

Tracy D.

Private Investor

Dan P.

Professional Athlete

Vinodh B.

Co-Founder of Saavn

(Billion Dollar Exit)

John B.

Professional Athlete

Ankita N.

Private Investor

Patrick W.

Real Estate Investor

Max S.

Sponsor

Tyler C.

Sponsor

Karl F.

Sponsor

Chris C.

Sponsor

Steven S.

Sponsor

Dr. Noel L.

Doctor / Dentist

Rajive A.

Doctor / Dentist

Michael C.

Real Estate Investor

Sheetal J.

Private Investor

Michael M.

Sponsor

Bob W.

Sponsor

Sumeet W.

Sponsor

Ray J.

Sponsor

Rick C.

Sponsor

Arleen G.

Sponsor

Greg D.

Sponsor

Mark J.

Sponsor

Sanjeevv B.

Sponsor

Dan G.

SFO

Isaac R.

MFO

Sahil N.

Dan P.

Sponsor

Brad O.

Sponsor

Private Investor Club Membership

Our private investor club was founded in 2007, has hosted 250 live events, published 13 books and produced more thought leadership on family offices than all of our competitors combined, and has over 4,000+ active investors making us the global leader in the industry.

7 Reasons to Attend this Summit:

- Meet and connect with 200+ ultra-wealthy investors & Family Offices. Shake hands with the fastest-growing investor type across the globe.

- New opportunities to sell your company or raise capital. Our investors have specific mandates for the businesses that they are either looking to help grow with capital or just straight-out purchase.

- Connect with smaller private and angel investors. This is the perfect place to connect with smaller private investors and angel investors that may be interested in investing with you. You’ll also connect with other start-ups on how they raised $20-$100 million and up.

- Grow Your AUM. Hear directly from family offices and ultra-wealthy investors on what they look for in a fund manager and obtain new clients at our event.

- Meet strategic partners for your real estate deals and funds. We advise, consult, and speak on stage to thousands of high-net-worth individuals looking to find great real estate deals that can provide them with cash flow and strong returns. If that is you, then you will want to make sure to attend.

- Strategies that get investors responding to your emails. A lot of times investors don’t get back to you because you aren’t targeting the right investor or the message is being delivered in the wrong way. Hear directly from our investors on how to approach them and talk to them directly at the event. Face-to-face will always build relationships faster.

- Investor contact information upon request. We know events can be limited on time, which is why we give you access to individual investor profiles through our on-site and virtual event software whenever you need it.

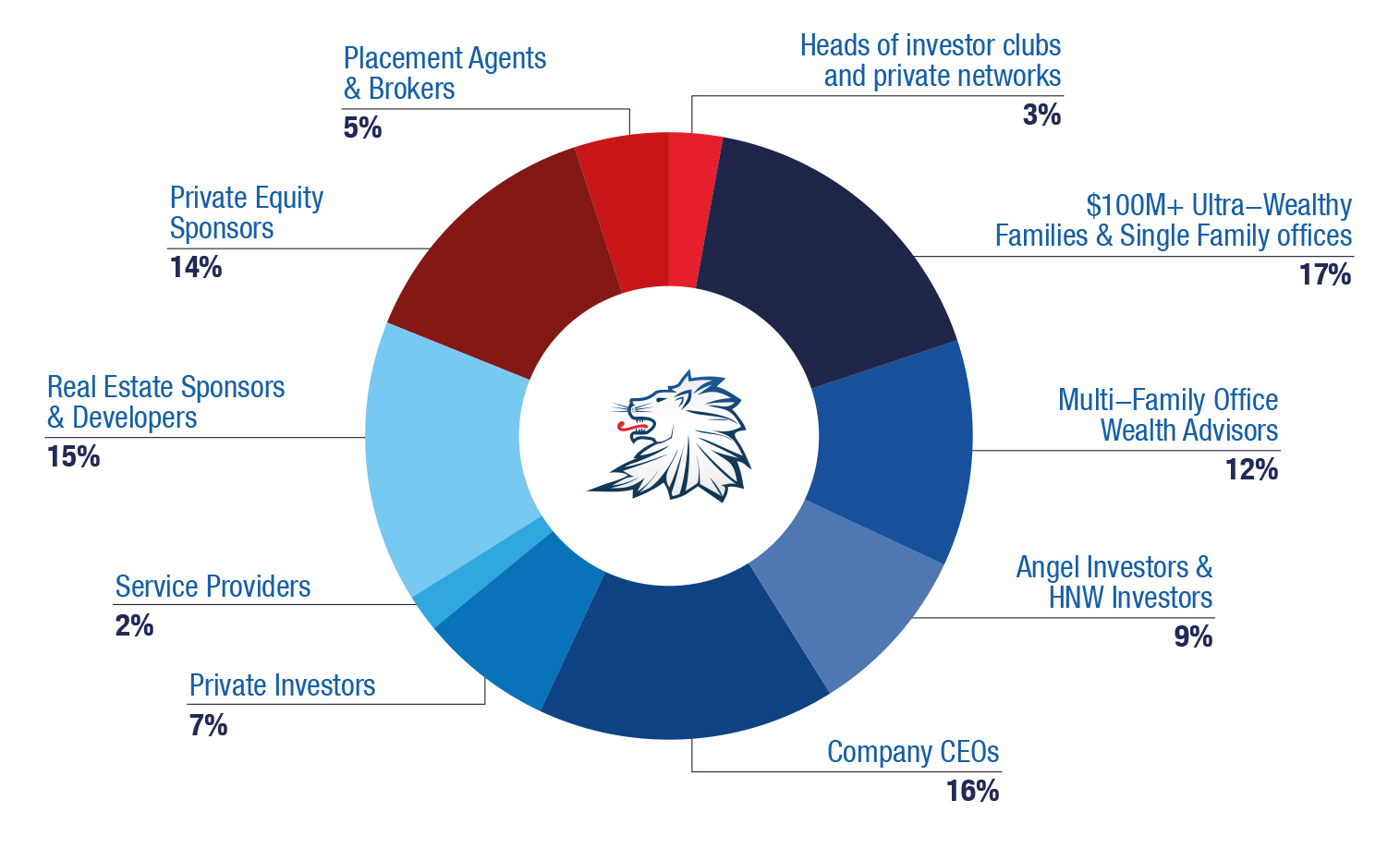

Who’s Going?

We have confirmed over 1,500 attendees for the 2023 Super Summit, including 700+ in-person guests. The Summit will also feature:

-

- Heads of 3 publicly traded companies

- A private billionaire

- Dozens of $1B+ family offices

We have another 200+ high net worth private investors and family offices attending that have submitted investment mandates to us.

Why 1,000+ Have Joined

We realize that even if you know you would get an ROI on your money invested in our club, it is your time that is most coveted and expensive to invest.

Well, you have probably heard of Keller Williams Realty with 200,000 real estate agents; their co-founder Joe Williams attends and speaks at our events, acts as an advisory board member, and pays for membership in our club. We do not pay him to speak, just like we did not pay Kevin Harrington, who was on Shark Tank and invented “As Seen on TV.” Tony Robbins & Mark Cuban were nice enough to answer our Billionaires.com questions recently, and billionaire Larry Namer, founder of E Channel, also found our events worth investing time in.

We have a video of billionaire Grant Cardone, who has spoken at our events several times, saying our founder Richard C. Wilson is the smartest person he has ever interviewed for his podcast.

If that isn’t enough proof that our community is real, we are not sure what else would be. As John on our team puts it, “I have worked at Credit Suisse as a broker, US Trust as an advisor, and I have never seen events with the depth of wealth seen at these events.”

If you want to tap into this community of investors and this perpetual learning machine which is the Family Office Club, then consider joining. If you do not, you will miss out on 1,000+ recorded investor mandates in our investor portal and mobile app, live in-person investor masterminds, and investor club summits each year.

In this space, it only takes one relationship, a single structure, or strategy to exponentially multiply the outcome from all of your hard work. You owe it to yourself to invest in starting your membership today. Please click here to join our investor club.

Our 2023 Sponsors

Mountain V

Norton LifeLock Benefit Solutions

Chapman Freeborn

Southern Impression Homes

Hedgehog Investments

UC Funds

Blue Waters Development Group

OptionAgent Capital Advisors LLC

Soundscape VR – The Musical Metaverse

Rockstar Capital

Capital Raiser Show

Caliber

Equity Trust

Return on Good

Youtopia

PPR Capital Management

Aravaipa Ventures

Heirloom Fair Legal

Energy Shares, LLC

The JG McHugh Group

bTd

Treasure Investments Corporation

Custom Capital

ELLAVOZ Impact Capital, LLC

Canovation

Syndicate Venture Group

Sarson Funds Inc.

Cirrus

High Gravity Resources

Spirits Capital Corporation

Unicoin

Scottsdale Mortgage Investments

Infinite Capital

Ibex Biosciences, Inc.

Green Flower Media

Versity Invest, LLC

Realty Investor Capital, LLC

Sower Farmland

Essential Realty Partners

Habacoa

JVC Capital Partners

Youtopia

AlphaTack

PayJoy

Karpus Investment Management

REEP Equity

Dynasty Wealth

Purim Ventures

Iris Energy

Pinkerton Wealth Management

Brennan Investment Group

Speak To A Club Advisor

We’re Here To Help

The largest association in the family office wealth management industry with 100,000+ current members—become a member today. Since 2007, the Family Office Club has been working with family offices by helping them create family offices, identify deal flow from our live conferences, and connect with quality investment firms and independent sponsors.

Join Our Investor Club for These Benefits

Virtual Investor Discussion

Panel Recordings

Connect live with investors after hearing their preferred structures, fees, and strategies.

Raise Capital Faster

Than You Have Before

Avoid expensive capital raising mistakes & access strategies our members use to raise $1 Billion+ a Year.

Stream 1,000+

Investor Mandates

Your whole team can stream and tap into 1,000+ investor leads via our mobile app

Investor

Lead Lists

Purchase our Investor Excel List at a 25% discount as a member.

Corporate VIP members get immediate access to the 24,000 global contacts.

Pitch Deck Coaching

and Deal Analysis

Receive a candid analysis of your deal & investor materials with 20 suggested changes to boost results.

Access Thousands

of Investor Leads

Raising capital is about building relationships with people who have something in common.

Our community bridges that gap.

What Our Members and Investors Have To Say

“This is my third event. Coming here it’s like an old family now, but they’re very interested in what you’re doing individually. we’re going to raise a lot of capital just from the people that are here.”

Joe Williams

Co-Founder, Keller Williams

“It’s as always, this is not our first event. We’ve been to multiple ones, I think around eight now. And it’s very much a community of investors and companies that are striving to achieve great things together.”

Rick C.

“We’ve been very, very tickled by everything that’s going on here, and when you look at it from a holistic practice, we couldn’t find a better spot to be able to be, and we’ve been at a number of other events. So, in comparison, you guys are top-shelf.”

Michael C.

“I would recommend the event. In fact, I have recommended these events to others who asked me what groups they should consider belonging to in the family office space and I have referred to the Family Office Club.”

Alexandra C.

Investor

“The biggest takeaway is the quality and the quality of the people and the quality of the interaction that you have with the people that are participating in your venues.”

Tracy M.

Single Family Office

“Richard’s Investment Marketing Seminar in NYC was educational, current, and inspiring. We all benefited from Richard’s breadth of knowledge surrounding the hedge fund marketing arena as his presentation delved into the granular level, while only providing valuable, relevant information. His stories and anecdotes were woven seamlessly into the presentation, serving as both motivational and informative tools.”

Justin B.

“I have been in contact with Richard Wilson and his staff for over a year and a half. I was not able to commit to becoming a charter member for various reasons until last month. While the invitations to join were plentiful, so was their patience and their content.

The only regret I have is that I wasn’t able to commit sooner. I think of the deals that I was not able to participate in because I wasn’t able to source them properly. It was truly one of those drinking from a firehose summit, but the included materials and networking will make the information easier to absorb and implement. For anyone sitting on the fence about joining, I give my highest recommendation”

John A.

“The content of the presentations and the makeup of the panels was really great. I wish there was more time, and perhaps a bit of structure to the actual deal-making component of the event. Everyone there seemed to have deals, capital, or services that would benefit others, and it was difficult to explore the right opportunities in the networking sessions.”

Esteban V.

“Great conference with a wide variety of speakers. I learned interesting tidbits of information to consider. Really friendly people, and I had a dozen people come up to me, complimenting my presentation. All in all, it was a first-class event, very professional, and well run.”

Justus P.

“It was a pleasure meeting you today at the NYC Investment marketing Seminar, hosted by you/your firm. I thoroughly enjoyed your presentation and your investment relations ideas/insight. Again, thank you for hosting such an informative and thought-provoking event. I look forward to attending future events held by your firm.”

Mike K.

“Highly valuable education to Family Offices. Great environment to learn and meet. Networking is beneficial.”

Marquita M.

“We have made lots of new connections since we’ve just been here for two days. As a matter of fact, yesterday we were with a group and I said, wow, yesterday we did such as they say, Carol, it’s only been one day. So that’s to say that it feels like we’ve been here for many days because there’s been so much going on, so much interaction and interface with these leading experts and professionals. It’s been remarkable.”

Carol H.

“Richard’s conference was a very well organized and well attended. The speakers/presenters were excellent and highly experienced in the field. I picked up useful info on the macro view of family office issues and family office criteria for selecting individual managers.”

Dan D.

“As always, Richard’s group has again delivered great information and speakers on Family Offices. If you can only join one occasion- this is the one.”

Don F. W.

“Great event and worth my trip from Beijing.”

Alex G.

“Jennifer did an excellent job of showing me the Family Office website and I look forward to using the tools!”

Good S.

“The event was time well-invested. The presenters were very knowledgeable, and the information gained will be useful in our multi-family office practice.”

Joseph M.

“I am surprised at the speed that I have been called back and the minor…and I do mean minor issues were resolved…no hassle no fuss just fast, friendly, service and they actually remember your name…and are genuinely happy to speak with you…in this day and age this kind of service is an anomaly.”

Adam V.

“I have been to 2 different conferences now: London and Chicago. The formats have been great and run really efficiently. The panel discussions have been fantastic and really interesting with great speakers in very smart combinations. Chicago, for example, had a wonderful (if not tumultuous) back and forth around the argument of investing in public vs. private companies as well as passive vs active investing. These conferences and the overall Club membership create what I think is today’s epicenter of the family office environment from a marketing perspective for both introductions as well as becoming more familiar with the space and how to successfully navigate in it.”

Eb G.

“The focus on direct investing, and the expertise assembled on the topic is what made the event worthwhile. There are lots of places to meet Investment Managers, and every conference has basic back office service providers but hearing from people and firms who can really help with deal sourcing, due diligence and executing on direct deals is highly valuable.”

Davidi

“You have provided investors with a wonderful resource. Now you should provide them with a classic money management resource that most can’t identify.”

John D.

“Just wanted to say thank you again! The conference was awesome and we appreciated all of it. We definitely made some great connections and heard some good ideas. We have a lot of planning and strategizing ahead of us. On another note, you were absolutely right about Goodwill being a unique platform for some of these offices. They were excited to see the name involved. We actually met someone who has a roundabout connection with the Salvation Army, and we were able to get some better insight into their model which surprised us, but it was definitely awesome to hear about. So, again, thank you. We look forward to all the next visits!”

Will G.

“I can vouch for the quality of Richard’s Family Office Club events and members…it’s a top-notch network with many investor members as well! Their Pitchdecks team has developed Unified Global’s websites, decks, and overall branding which has been phenomenal!”

Tracy D.

“Overall I am super happy, satisfied, and grateful for this community of high-level individuals working on amazing projects that create impact. The staff and support is a class act. They’re quick to respond, and haven’t failed me yet. The content, the access, the networking and all the above are phenomenal. I’ve recommended people to the community and they’re quite happy too.”

Tron P.

“I really enjoy every event that I attend, whether a workshop or summit. I continue to pick up useful tools while building relationships. Kudos to Richard and his team”

Bob D.

“Richard’s webinars, seminars, and live stream videos are quite amazing in the insight he regularly shares. The membership is valuable if you are setting up a family fund or seeking to partner with family fund offices”

Karen R.

“FOC provides essential capital raising & investor information clearly, its website enables easy access to it, and the FOC team”

Catherine P.

“I have only attended live events so far and am very satisfied.”

John D.

“This Richard here is a smart guy, out of all of the power players I have had on this show, he is the smartest guy we have had here.”

Grant Cardone

“I can learn every day, every moment, I’m in this environment and I appreciate that so much. So that’s probably my biggest takeaway, just the fact that it’s not a waste of my time, it’s an incredible positive investment in my time.”

Richard G.

“I’ve had the opportunity to make a number of connections with individual investors, companies that are offering investment products to other investors that we can make meaningful connections to help provide our services to, as well as the other speakers that were on the various panels.”

John B.

“We’ve been very, very tickled by everything that’s going on here, and when you look at it from a holistic practice, we couldn’t find a better spot to be able to be, and we’ve been at a number of other events. So, in comparison, you guys are top-shelf.”

Michael C.

“This is our second family office event and they just keep getting better. The group here is super intimate, fantastic, really engaged, asking lots of questions, and a ton of good traffic.”

Ann O.

“This is our second family office event and they just keep getting better. The group here is super intimate, fantastic, really engaged, asking lots of questions, and a ton of good traffic.”

Ann O.

“It is a great knowledge-adding event. Every high net-worth individual and Family Office must attend.”

HP S.

Single Family Office

“Terrific event. It provided great insights into the pitfalls many managers make in setting up and marketing their funds. The exercises provide a great opportunity for self-examination and networking“

Alan S.

“Great opportunity to learn from the panels and then go have a face-to-face conversation with the person/people you wanted to make contact with after the panel was over. Another great opportunity was the receptions at the end of the day. We made numerous contacts walking around during those times. These were also times to speak with panelists still there and have follow-up conversations.”

Bart

“The event content was relevant and educational, after the event my mind was racing with new ideas and ways to improve all aspects of my strategy and implementation of my strategy. Like any great coach or motivator I left the event more inspired and with a deeper desire to succeed.“

Jay R.

“The event was well worth my time to fly to New York. You gave me a lot of great ideas to raise more capital.”

Jace V.

“As a small boutique firm in the family office space, the Family Office Club seminars have been a valuable resource for our firm giving us the opportunity to learn from industry insiders to help us grow our business.”

Karen M.

“The event really provides new and emerging managers with the toolkit and strategies to really begin establishing the foundation for capital raising and growing their business to the next level.“

Tom A.

“Impressed by what it has to offer. The database is Big, and the investors are mostly pretty open to contact”

Boris M.

“It’s a brilliant platform to connect Investors and build a network. The videos are quite insightful.”

Simon I.

“You’ll leave Richard’s event with actionable strategies you can instantly apply to make your business more effective.”

Kimberlie C.

“It was a pleasure meeting you today at the NYC event, hosted by you/your firm. I thoroughly enjoyed your presentation and your capital raising ideas/insight. Again, thank you for hosting such an informative and thought-provoking event. I look forward to attending future events held by your firm.“

Mike K.

“This was my first family office event and it was great. I met a lot of interesting people and learned a lot. If you don’t know where to start, start here.”

Raymond G.

“The presentation was excellent, very practical, and worth of its own merit. I know more now than if I was to try and learn this material through other courses. Richard is down to earth in presenting and his advice is doable and real. ”

Dennis E.

“This is a great network. It would be more helpful if attendee lists could be circulated in advance. It would also help if there were some way to distinguish those attendees with capital from those who are service providers”

Neil W.

“Today I have had the opportunity to learn about Family Offices from the masters, which is so inspiring. Thank you Richard!”

Jerry D.

“The Family Office Club summit in Miami is truly SUPER! Humble, intelligent, and direct, allowing all attendees to maximize time and develop relationships that will turn into real deals. Every attendee/panelist/staff member is truly world-class.”

Dan

“My experience is that Family Office Speakers and materials are quite relevant and essential to my business success.”

Emmanuel A.

“I appreciate the way I was received by the first one, participating in the same club. Service, reception, attention, and empathy were differentiated from the FOC team. I hope to contribute and repay. Grateful and even the next one, cordially, Fernanda”

Fernanda L.

“The live events provide excellent content for either newcomers or experienced investors to the Family Office space”

Thomas V.

“Because of the Family Offices, I have furthered my Private Equity Career considerably”

Van W.

“I was very impressed with the show and the organization, and was grateful for the opportunity to speak to such a strong audience.”

Michael F.

“Very helpful, organized for the process and I am glad to be a charter member.”

Alex K.

“I am still learning- I like the relaxed atmosphere of the events. Very informative. Best value in the market for building a network of advisors you can trust.”

John D.

“Everything has been great so far”

Zach S.

“Wilson family office is one of our go to sources for everything related to capital raising, investment strategy and risk adjusted returns”

Jake H.

“Excellent unique approach to positioning, creating value, and raising capital! ”

Dino P.

“I have found the practical insights from the Family Office Podcast and then also the videos to be the most helpful in figuring out how to improve our investor relations processes”

Chris B.

“Very knowledgeable staff, and ready to answer any questions.”

Paul L.

“Super experience and network contacts at CapitalCon – NY. My first in-person experience with Family Offices Club was exceptional. Thanks, Family Office Club Team! ”

Mary H.

“The value is amazing! I learn so much and feel comfortable that there is always more provided for me to learn.”

Amed H.

“What this event has given me the opportunity for me to do is really package what we’re doing in a way that is digestible for investors and understand what the market is looking for and see where we fit in. Because it’s not that different from what we say to customers, but it’s a slight pivot. So I’m understanding the landscape and getting feedback and this event has given me the opportunity to really refine what I’m saying.”

Merisa F.

“I’m a private investor and the reason why I come to Family Office, this is the fourth time I’ve been to the Family Office event. Actually, this is the fourth time I’m a speaker. The reason why I come here is that this is without question the premier event for private investors like me to find new syndicators, fund managers, and project sponsors. I find really good deals here and this is not only do I want to be here as a participant and do networking but also when I’m on stage it gets me the exposure to get a lot more deal flow opportunities or offerings. So before the last Family Office, I was getting pitched about two to five private placement offerings per month and then after the last one, it’s now two to five private placement offerings per week.”

Marc H.

Private Investor

“A very good event, worth the special trip from London. The event was delivered in a very professional atmosphere and was very good value for the money.”

John B.

“Single Family Office Club is very thoughtful and Organized. Richard C Wilson is an excellent communicator and thought provoker. I have attended several of his events in the past 12 months and have enjoyed every one. His staff is very helpful and friendly. I can easily recommend participating in any conference that makes sense for a participant. Your time and effort will be well spent.”

L. M.

“We were very fortunate that when I first got introduced to this, we brought on a very large family office and we’ve since then done three deals in the last six months with that family office.”

Alice C.

“Absolutely sincere and a great source and fountain of information. Real life examples of what to do regardless of the level of the participant, useful for everyone from beginners to pros in capital raising and fund marketing.”

Gene C.

“Great! We needed your sales perspective, a new angle for our type of business.”

Manuel L.

“It was such a great opportunity to be able to speak on a panel with other managers in the space and really understand what they’re doing from a capital raising standpoint that maybe we weren’t. So that was a great experience and then in addition I’ve really enjoyed being able to meet people and just network and really build our network even further.”

Andrea H.

“Excellent experience at the Family Office Fundraising Catalyst workshop. Well organized, concise and actionable information with a healthy dose of ‘been there, done that’ that really brings the advice home. Definitely worth the time and money. I plan to maintain my Charter Membership and attend as many of the events as I scheduling allows. Need to work on this form though. I answered 5 of 5 on things that I have not yet experienced. Just assuming that they too will be as well crafted as my first experience”

Matt D.

“Rich insight across a multitude of Family Office challenges and opportunities. Top-notch presenters and high-energy networking. Well done.”

Jake R.

“The event tells me just what marketing materials I need and some guidance on how to get started. Richard is very knowledgeable and sincere (not a typical sales guy), which is much appreciated.“

Judy S.

“This was my first Family Office Club event. I thought overall it was well organized. Good venue. Well attended – better than I thought. Also, many of the attendees I spoke with were ‘regulars’ and spoke very highly of the club and its events. That is always good to get unsolicited positive feedback like that. I thought Richard did a really good job of 1) speaking for about 6 hours straight, 2) getting through a lot of material, and 3) politely and diplomatically cutting off a few people whose comments were a total waste of the group’s time. Point #3 takes some skill, and I really thought Richard did an admirable job of that, which is not an easy thing to do but distractions in these types of events can de-rail people so it’s important.

The content overall was fairly general, but accurate and important. I appreciated the specific examples more than the general ideas, but that may be because I have been in this world for a while so things like ‘don’t be pushy’ go without saying in my mind. Again, I did like the more specific examples of structures and strategies that family offices are doing now – real-time information and real examples are very beneficial. All in all I was glad that I happened to be in NY and could attend this.”

Ryan

“Great content and speakers, always looking to learn from Richard.”

Ahmed H.

“5 Star organization. I have been in financial services for over 20 years. I have been trying to get involved in the family office market for quite some time, but I have never come across and organization that offers the services that Richard Wilson and his team provides. Most of the other family office organizations will sell you a list and you never hear from them again.”

Oliver Y.

“This being my first summit I found the quality of the event, speakers, and vendor exhibit excellent. The format of the event allowed the ability to mingle and discuss your specific area of interest. Looking forward to attending a few events.”

JMG

“Thank you Family Office Club!”

Forrest B.

“The content provided by the Family Office Club is well worth the cost of membership. We found their material extremely helpful in tweaking our presentation to family offices.”

Steven R.

“I attended your family office event on Friday in Chicago. It was outstanding from speakers, content, networking, venue and overall event management perspective. Great job!”

David P.

“Outstanding in every way from the in-person events to the daily news and notes updates. Richard’s team is outstanding from the newest to the most experienced employee”

Bruce R.

“I want to give a big shout-out to Richard Wilson and his team. I’m very impressed with how your team is organized and how you use technology in your conference versus competitors”

Michael

“Richard provided a great amount of detailed content in a very conversational way and his keeping on schedule with all of the questions being asked was impressive”

Barry J.

“I have been working with Jennifer, and she has given outstanding customer service.”

Dan K.

“I find the organization very professional and exceptional. The workshops and events are well run, have great content, and are extremely beneficial.”

Gideon

“Great information, valuable comments, congrats”

Eric B.

“Excellent event including presenters, content, venue, food organized process, and network prospects ”

Martin S.

“Abundant amount of valuable content and personalized assistance not to be found elsewhere!”

Mark K.

“The 15 min quick value point layout of the meeting schedule was very effective. Although the Miami meeting was great, this most recent NY meeting was excellent.”

Todd D.

“Richard Wilson and Family Office Club run tight, disciplined events that always deliver value. I highly recommend their events.”

Jim S.

“I attended a capital raising boot camp in Houston last year and found the training to be enlightening and helpful. ”

John D.

“Great source of rare and valuable information!”

Bruno K.

“Excellent content. Great networking. Fantastic events. Well worth the investment. ”

Robert T.

“The experience has been great. I’ve met a lot of people from all over the country who are doing things internationally in different areas and different markets. It’s been eye-opening to meet a lot of people who are investing in different things from debt, equity, funds, and plant-touching things. It’s been great.”

Sean H.

“I know I’m always going to meet interesting people, highly successful people that have done some quality things. Sometimes I can turn into investment opportunities personally and professionally that I move into.”

Michael S.

“I love Richard’s event. Whether you are looking to get investment or you want to find something to invest in, or you just have a skill set that you need to fill in your family office or in your business, you’ll find people here to connect with. It’s a great networking opportunity.”

Harry K.

“From our last event, we got direct investors into our fund, Outpost Ventures, where we invest in dual-use technology, bringing in government funds and private matching funds that we’re able to boost investor IRR in.”

Dave H.

“The event did an excellent job of consolidating thousands of hours of information into a single day. Worth 1000%+ my investment of time and money.”

David W.

“As a first-time attendee of Family Office Club events, I was impressed about the quality of presenters and those in attendance. I am looking forward to attending more of these events in the coming months.”

Jerry L.

“LOVED THE EVENT!! Exceptional! Learned so much – Chip Perkins’ speech was great. Richard’s wrap-up points – AMAZING, been watching Richard for a while but overly impressed by Richard in person.”

Cameron R.

“We have been Charter members since inception and continue to find the quality of the ever expanding content to be incredible. From Richard at the helm to the support staff at every level, the services provided are as though you had Praxis Capital in mind. Kudos to the whole gang at Family Office Club!”

Bob D.

“After becoming a Charter member over the past several months, I have to give the leadership (Richard Wilson) and his staff nothing but high marks. I have recently accepted a position as Corporate VP of Finance with a rapidly growing Texas home builder. The tools, training, and networking events have prepared me to meet our capital raise target for this year of $20MM. I am happy to report that through your club, we have met both potential lenders and investors that are interested in our deals. So, thank you and I look forward to a long-standing relationship with the Family Office Club”

Robert

“I spoke for 13 minutes at the Family Office Club event in NYC and I raised $133M from those connections. Thank you for allowing me to be part of this community, it has been great”

Adonis L.

“This conference and your conference I attended in Los Angeles last month is by far the best venue I have experienced.”

Michael H.

“A very effective organization in educating on important financial and business topics while connecting with extremely successful entrepreneurs and luxury companies. I highly recommend attending the Family Office Club events as well to see for yourself.”

Michele L.

“This event differentiated the truly important tasks and processes from those that just eat up time. The material helped me focus on my attitude and habits to drive the behaviors to increase chances of raising sticky capital.“

Michael M.

“Luckily after I asked a question in the panel discussion, there were four family offices that just came and tracked me down and it has never happened before. It’s usually the other way around.”

Alicia L.

“The family office training event provides an opportunity for all industry participants together in a selective group and share ideas, concerns, and network FO issues. For us in the advisory and consulting world, this is an excellent source of knowledge and contacts.”

Isabella F.

“Richard Wilson’s expert knowledge and current insights about the investment fund universe provided an invaluable checklist of the dos and don’ts in capital raising and investor relations.“

Johanna T.

“It’s good to know such valuable, informative, and collected information on the family office industry which we won’t find even on search engines like google and Investopedia. I would like to extend my journey to doing master’s certification as well. your support & service on request mails is wonderful, I really appreciate the team for their patience”

Padmavathi

“This was a fantastic, educational experience. Incredible content, great perspective and well-chosen speakers. Nice, diverse presentations.”

David S.

“Richard presents closed-door information from important contacts that provide powerful insights. Thank you.”

Tony H.

“Richard and the team have put together something extraordinarily rare and special–a resource where the vast majority of the content and speakers are directly relevant to my practice. I walk away from any event feeling that 1) I’ve learned something new 2) there’s something that makes me a better, more insightful investor and thus more valuable to my partners AND potential partners, 3) that I’ve invested wisely as a Charter Member”

Brian F.

“It was very good. I think anything in this life can be improved on. I believe the means of identifying ‘who is who’ and what a ‘charter’ really means as far as; am I an Investor?, an Entrepreneur?, or ? could easily be improved on. Then because after a speaker presents and walks to the side, the games seem to begin, the people line up, wait to grab a card, etc., and could also be modernized so that everyone has an equal opportunity to make the best use of everyone’s time. I would like to end this review by saying it was a group of very kind and courteous people that the family office club has drawn together.”

Gene A.

“Couldn’t be happier with our membership in the Family Office Club. Great events, great information, and more importantly, great people! ”

Edmon R.

“The event was great, I learned a lot, and some were mind-opening concepts. I met some people who knew people that could help me raise capital, so that’s really worth it.”

Slavica B.

“I have read and attended several of your events and products. I am delighted with the content and am actively applying what I learn from them to my business”

Thomas C.

“Excellent, the new site is user friendly, I enjoy seeing my first name on everything adding a special personal touch. Everything is readily available scrolling versus having to hunt through different tabs is spectacular as well, WONDERFUL DESIGN!!!!”

Jake S.

“I always find the videos relevant and informative. One of the best resources for me as the managing associate in our small private consultancy, as well, for me as a trustee.”

J.R.

“The extensive knowledge and experience of the Family Office Club is an excellent resource for information”

John D.

“Great resource, the information provided is timely, accurate, and useful.”

George M.

“The videos are always well done and insightful. I am now investigating attending the funding conferences the Family Office Club hosts due to the key players they draw.”

Mike A.

“The videos are short, quick, and to the point. The live events are great – I made 32 new friends at Capital Con and picked up 5-6 capital raise requests. Daphny, Andres, and Jennifer were very helpful in compensating me for the Philadelphia live event (the date was switched after I had already made flight and hotel reservations, which were non-refundable). I’m very happy with my Charter Membership and highly recommend this Organization as it is yielding positive relationships and results.”

Andrew L.

“The Speakers were great, I learned a lot of strategies at the boot camps with Richard. What a great way to learn from FO’s and sharpen my skills within the boot camps.”

Jared D.

Start Your Membership

Questions?

Call us at +1 (305) 503-9077

Membership Bonuses:

- Access to Netflix-like Investor Portal. Our portal can be used via mobile app or on your computer, and includes 1,000+ investor mandates, 100+ capital raising strategy masterminds and webinars, and over 25 full length investor summits with 30-125+ investors speaking at each summit.

- Submit your pitch deck and executive summary directly to our CEO, Richard C. Wilson, for him to review your offering.

- Access all of our investor relations and capital-raising books, as well as our 50 tax expert interview series, and our 100 Capital Raising Titans talks. The talks feature 10-minute presentations from professionals who have individually raised $100 Million+ to $1 Billion+. They will share their strategies on how they achieved such significant funding.

The 100 recorded Capital Raising Titans talks alone are valued at $25,000+, and they completely de-risk your decision to join our investor club. There is no way you can listen to all 100 talks and not raise an extra $250,000+ or $1M+ this year.

- When you sign up for the event and membership we will schedule an onboarding call with our membership relationship director, Jennifer Velasquez, so she can give you a full walkthrough of how to use the 12 deal-closing resources we give you access to.